Mobile Finance

Can banks help young adults develop personal finance skills?

THE CHALLENGE:

In a rapidly changing financial climate, how can banks invest in the future of their users?

THE SOLUTION:

A simple and secure way for users to access all personal finance data in one place.

Real-time purchase details tool for spending “feedback loop”

Monthly spending comparison tool to monitor long term goals

Monthly budgeting tool for financial goal accountability.

THE PROCESS:

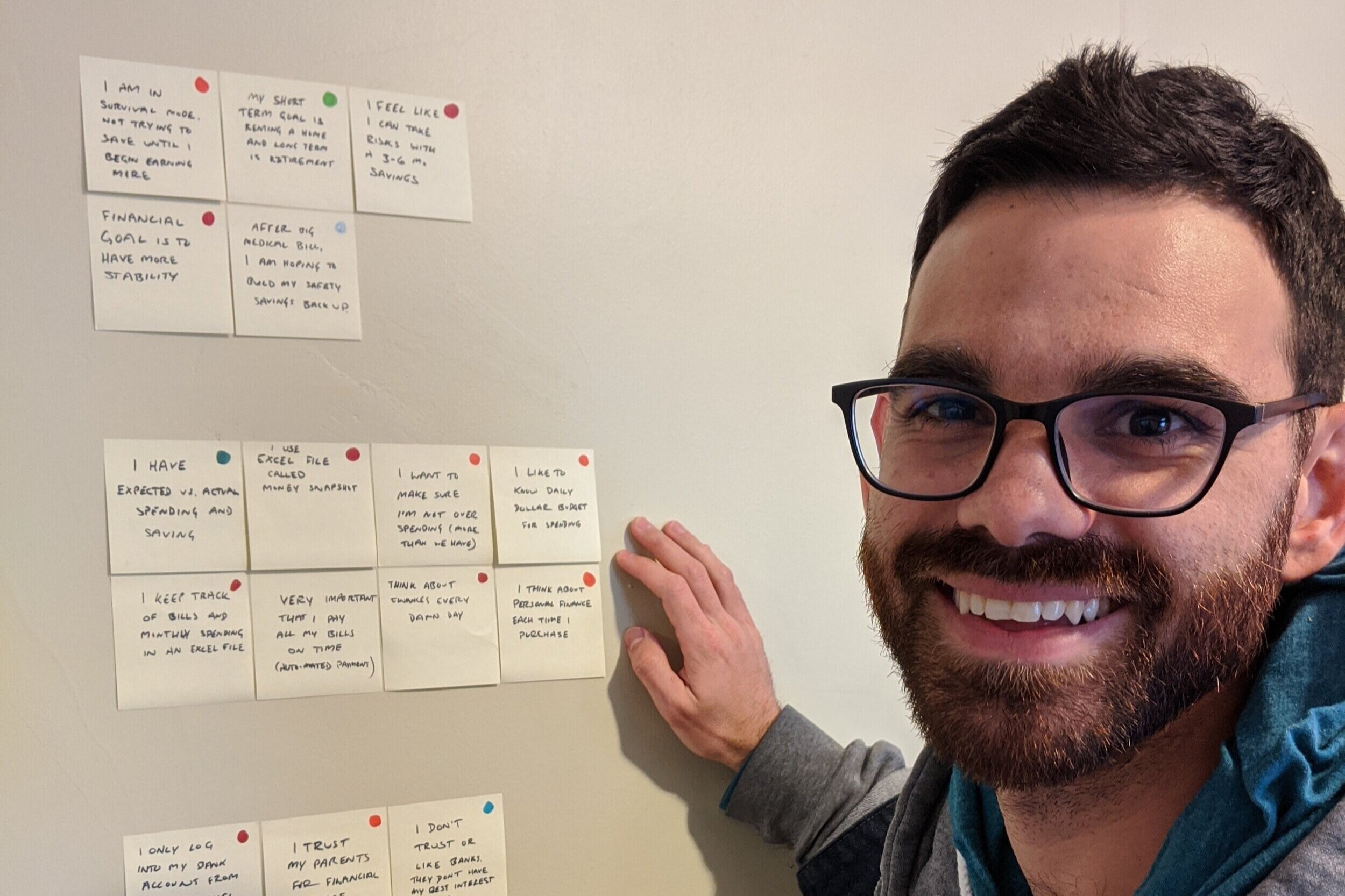

First, understand how young folks currently approach their financial future. What systems do they have in place? What works? What doesn’t? The most important part of this exploration is to keep an open mind and not jump to solutions. What is the actual problem we are trying to solve for?

Shout out to Post-it Note affinity mapping!

User Research

Many users have a working system of personal finance, however, almost all had frustrations around the ease and consistency of use for their current systems.

“I need budgeting features to be detailed enough for me to benefit from or I won’t use them”

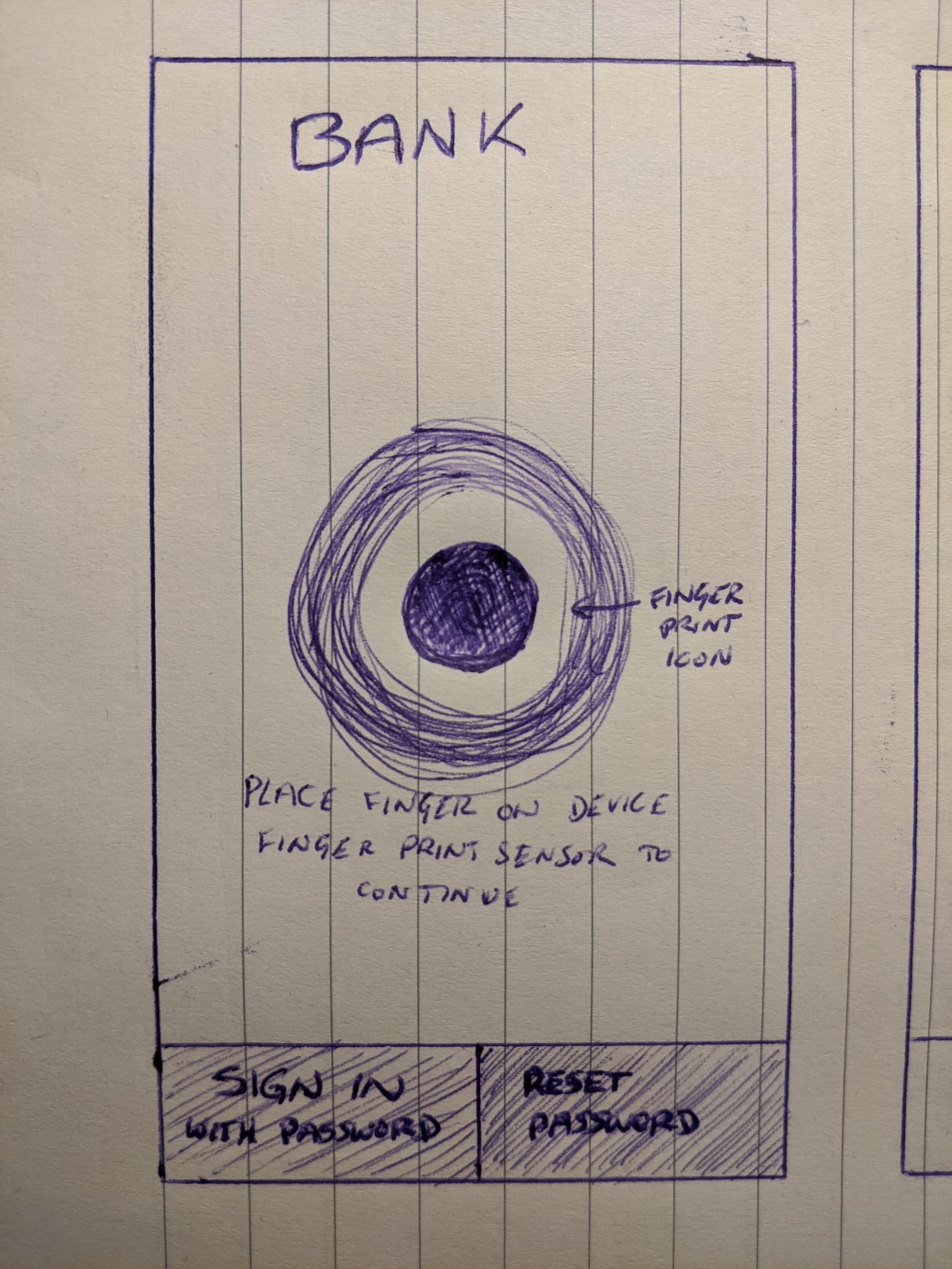

“Sometimes I can’t remember my password each time I sign in so mobile is easiest to use with my fingerprint”

“Switching between two bank apps is super annoying for me to manage money from multiple accounts”

User Goals

I found that personas can be a helpful exercise in empathy and distilling users goals in a simple story. For example: Anna needs a way to have accountability with her budget in order to better understand how to save money for her future.

Market Research

There were ZERO third party applications on the market that adequately addressed the issue of trust when handling financial user data. This created a huge obstacle when on boarding new users, so I expanded my analysis to include major banks mobile applications as well.

The current budget functionality provided by Chase Bank

User Flow

I decided to pivot my solution in order to take advantage of the missing features within mobile banking apps. I built this user flow as an application redesign, where users have already trusted the management of their accounts to the bank and can easily navigate to reach the data they are looking for.

Prioritization

I determined the highest priority items based on importance and effort to complete. Top priorities included: the ability to organize financial data from multiple banks and an easy to understand presentation of user data.

Information Architecture

I wanted to keep the UI design for the application simple using four main navigations. However, card sorting revealed some discrepancies between terms that do not currently exist within banking apps (Budget, Spending) so that required some additional tweaking.

Wireframes

Usability Testing

Usability testing validated my overall design, but also revealed important details that I had overlooked.

Final Prototype

Providing users with financial simplicity and security.

Showcasing an Accounts page, where accounts from multiple banks can be viewed in one place. As well as a Budget page, where users are given real time feedback on budgets. Also, a Spending page, where users can find details about their spending habits month over month.

High Fidelity Prototype

Click button below to see it for yourself!